Bitcoin is nearing its all-time high, fueled by a surprising wave of interest from major US financial institutions. Investment giants like Grayscale, BlackRock, and Fidelity are pouring billions into the once-volatile digital asset, transforming them into “Bitcoin whales” within the cryptocurrency ecosystem.

However, unlike traditional currencies constantly printed by central banks, Bitcoin’s unique design restricts its total supply to a mere 21 million coins. With 19 million already mined, and a significant portion likely lost or permanently unavailable, questions remain:

- Where are the remaining “whale”-sized stashes?

- What does this influx of institutional money mean for the future of Bitcoin, originally envisioned as a decentralized peer-to-peer currency?

- Should you buy Bitcoin now?

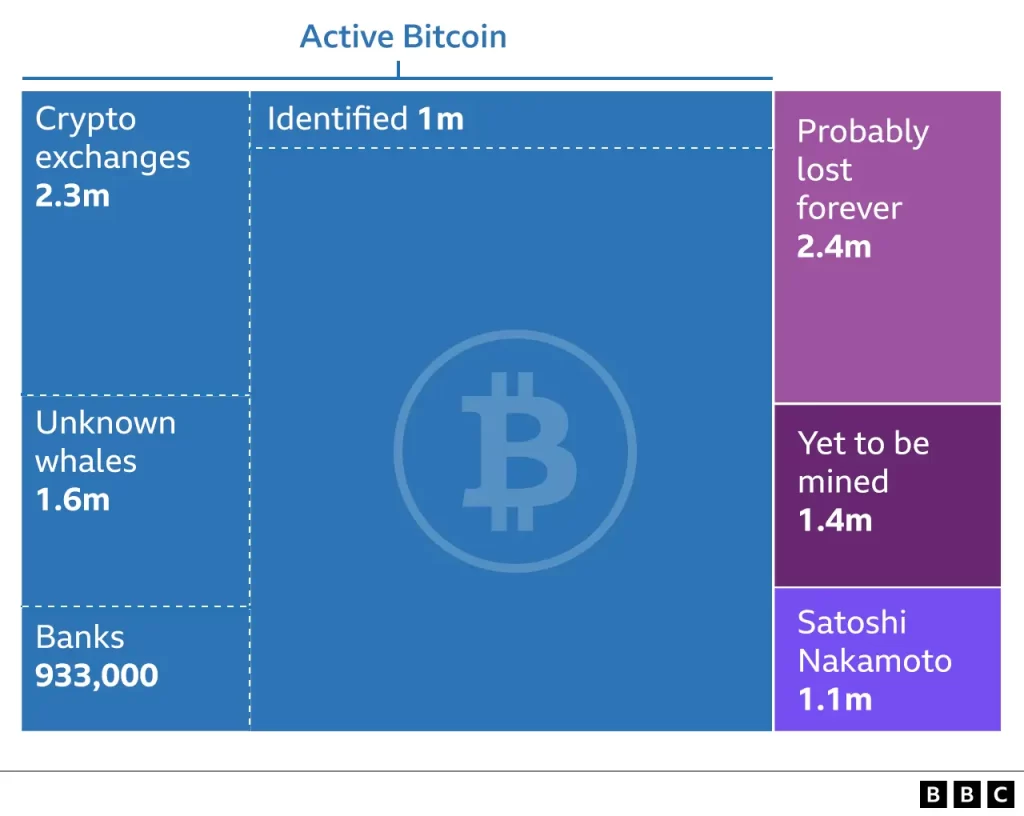

The following breakdown, compiled from research and publicly available data, offers a glimpse into the current distribution of Bitcoin and its potential implications.

- Lost: Estimates suggest 2.4 million to 3.5 million Bitcoins are permanently lost, often due to forgotten wallet details.

- Crypto-exchanges: Holding roughly 2.3 million Bitcoins, exchanges like Binance, Bitfinex, and Coinbase act as custodians for users or hold their own reserves.

- Unknown whales: Owning at least 10,000 Bitcoins each, these mysterious entities control an estimated 8% of all Bitcoins.

- Yet to be mined: Approximately 7% of Bitcoins remain to be mined, with the last one expected in 2140.

- Satoshi Nakamoto: The anonymous creator of Bitcoin holds an estimated 1.1 million Bitcoins, potentially making them the 22nd richest person globally.

- Regulated investment firms: These giants, like Grayscale, BlackRock, and Fidelity, hold 4.5% of all Bitcoins through new financial products like Spot Bitcoin ETFs.

- Law enforcement: Nearly 200,000 Bitcoins are seized by authorities globally and held for future auction.

- MicroStrategy: This software company is the largest single corporate owner, holding 193,000 Bitcoins.

Other notable holders:

- Block One (crypto-software company)

- Mt Gox (lost in a hack)

- Winklevoss Twins (investors)

- Tether (crypto coin company)

- Publicly listed Bitcoin miners

- Tim Draper (investor)

- Michael Saylor (MicroStrategy founder)

- Tesla

- Block (payments company)

- Peter Thiel (investor)

- El Salvador (the country)

General public: Holding an estimated 50% of all Bitcoins, this group encompasses individual investors and those holding funds on exchanges.

The Price Surge and the Future

Interestingly, the recent price surge may not be driven by individual investors, but rather by the institutional buying power of these whales. This raises crucial questions about the future of Bitcoin, originally envisioned as a decentralized financial tool.

Should You Buy Bitcoin Now?

This is a complex question with no definitive answer. Bitcoin is an inherently volatile asset, and the recent price surge may not be sustainable. Here are some factors to consider:

- Risk tolerance: Can you withstand significant losses if the price drops?

- Investment goals: Does Bitcoin align with your long-term investment goals?

- Investment research: Have you thoroughly researched Bitcoin and the broader cryptocurrency market?